Advance Beneficiary Notices (ABNs) and Waiver of Liability in Pain Medicine

Cite as: Schwartz G. Advance beneficiary notices (ABNs) and waiver of liability in pain medicine. ASRA Pain Medicine News 2026;51. https://doi.org/10.52211/asra020126.013.

Introduction

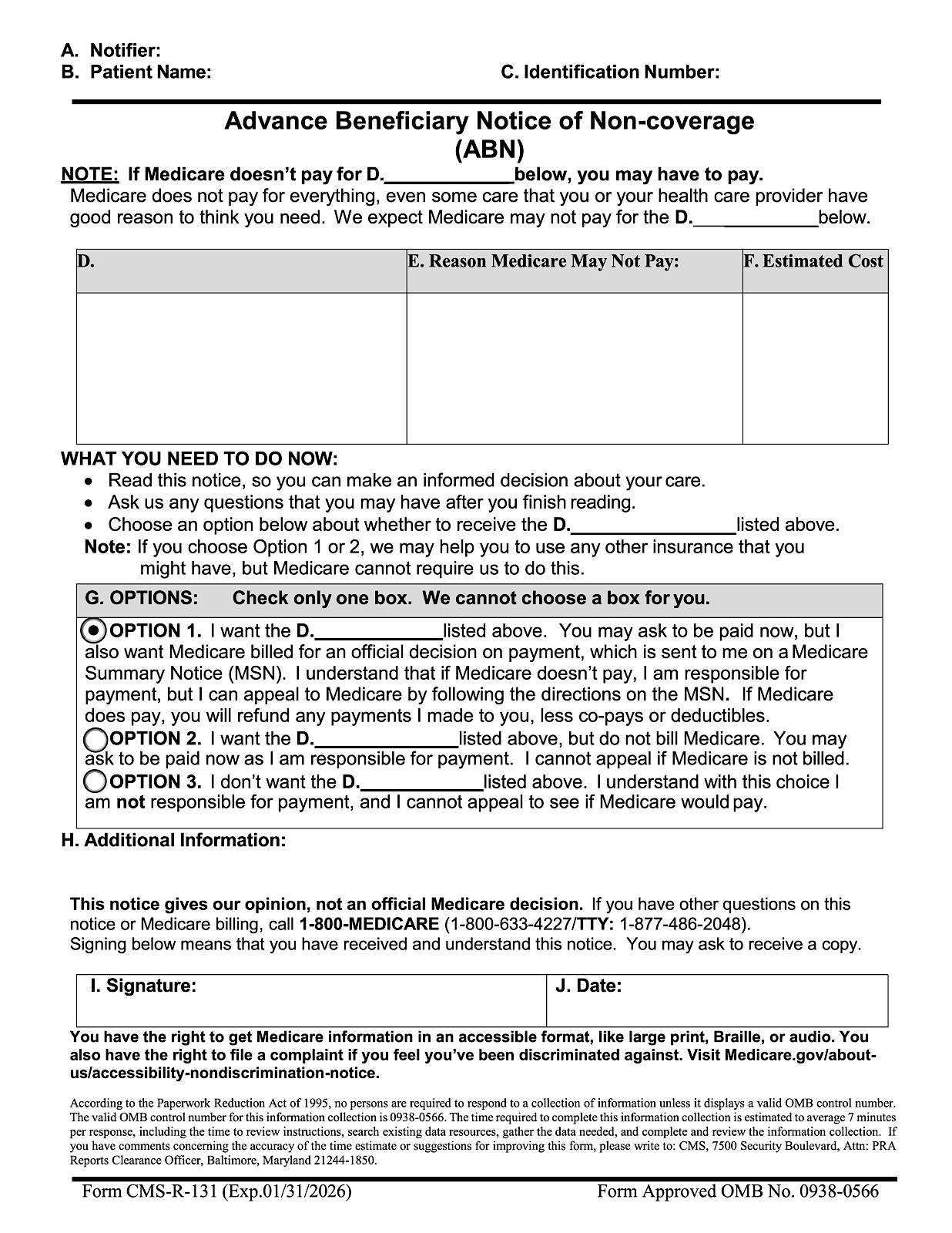

The advance beneficiary notice of noncoverage (ABN) is an essential communication and compliance tool for pain practices caring for Medicare beneficiaries. Based on guidance from the Centers for Medicare & Medicaid Services (CMS), the ABN informs patients when Medicare may not pay for a service that is usually covered but may be denied in a specific case. This protects both the patient and the practice by clarifying potential financial responsibility before the service is performed.

What is an ABN?

The ABN is a standardized form used for original Medicare patients. It notifies the patient that Medicare may deny payment for a particular service, explains why payment may be denied, provides an estimated cost, and requires the patient to choose whether to proceed. A pain practice may incur financial liability for the service without a valid ABN when a Medicare denial is likely.1-3

Under the Social Security Act, providers may be protected from liability when they could not reasonably know that Medicare would deny payment. Once the provider becomes aware that Medicare is likely to deny a service, the ABN serves as the mechanism that shifts financial responsibility to the beneficiary. If a required ABN is not issued prior to the service, the provider is responsible for the cost.4

The Difference Between an ABN and Waiver of Liability

An ABN is a written notice given to a Medicare beneficiary before a service is provided. Its purpose is to inform the patient that Medicare may not cover the service, explain why noncoverage is expected, and allow the patient to choose whether to proceed. When a correctly issued ABN is in place, financial responsibility may shift to the patient if Medicare denies the service.

The Difference Between an ABN and Waiver of Liability for Commercial Insurance

An ABN applies only to traditional Medicare beneficiaries and is subject to strict federal rules. Commercial insurance plans do not use the Medicare ABN and instead rely on financial responsibility waivers or non-covered service agreements. These waivers are contractual rather than federally regulated, and they vary by insurer.

| Feature | ABN (Medicare FFS) | Commercial Waiver of Liability |

| Applies to | Original Medicare only | Commercial insurance patients |

| Required form | CMS-mandated Form CMS-R-131 | No standard form; varies |

| Purpose | Notify patient of likely noncoverage and allow liability shift | Notify patient of likely noncoverage or self-pay requirement |

| When required | For the usually covered services likely to be denied | For non-covered or uncertain coverage services per policy |

| Legal basis | Federal statute (SSA 1879) and CMS regulations | State contract and consumer protection laws |

| Patient options | Must choose Option 1, 2, or 3 | No mandated option structure |

| If not issued when required | Practice is financially liable. | Practice may be liable unless a waiver exists |

| Medicare Advantage (MA) use | No (MA uses their own forms) | Yes, commercial waivers may apply to MA, depending on the plan. |

ABN in Pain Medicine

Medicare administrative contractors (MACs) publish local coverage determinations that define frequency limits and medical necessity requirements for procedures commonly performed in pain medicine. When a patient exceeds these limits, Medicare is likely to deny payment, and an ABN must be issued if the physician still believes the service is medically appropriate.

Most MACs limit epidural steroid injections to four sessions per spinal region within a 12-month period. If a patient has already received the maximum number allowed, but the physician determines another injection is needed due to persistent severe pain and functional limitation, Medicare denial is likely. A mandatory ABN must be issued before the injection to shift possible financial liability to the patient. Medicare policy often requires that radiofrequency ablation (RFA) not be repeated sooner than 12 months after a successful prior procedure unless exceptional circumstances exist. If a patient's pain recurs earlier and the physician recommends repeating the procedure at 6 months, the repeat RFA may fall outside Medicare coverage rules. A mandatory ABN is required to inform the patient that Medicare may deny payment due to early repeat timing.

These two scenarios differ from never-covered services (eg, platelet-rich plasma) because epidural steroid injections and RFAn are normally covered services. Noncoverage arises only when coverage limits are exceeded, making an ABN necessary to properly notify the patient and transfer financial responsibility.

When to Administer an ABN

- Frequency limits or duration beyond Medicare coverage policies, such as repeated epidural steroid injections or RFA sooner than normally allowed.

- Services that may not meet reasonable and necessary criteria, such as injections without adequate documentation of functional impairment or conservative therapy.

- Services are usually covered by Medicare but not in the patient’s specific indication, such as neuromodulation for non-covered conditions.

- Never-covered services may use voluntary ABNs for transparency.

- ABNs are not used in emergency or urgent care situations.

Implementation Tips

- Always use the current CMS approved ABN form found on the CMS website.

- Create internal indicators for common pain procedures that may require ABNs.

- Educate all staff on when and how to issue ABNs.

- Document clearly why denial is likely and that an ABN was completed.

- Avoid blanket ABNs, which are not permitted.

References

- Financial liability protections. In: Medicare Claims Processing Manual. Baltimore, MD: Centers for Medicare & Medicaid Services, 2024. https://www.cms.gov/regulations-and-guidance/guidance/manuals/downloads/clm104c30.pdf

- Centers for Medicare & Medicaid Services. Beneficiary notices initiative (BNI). https://www.cms.gov/medicare/forms-notices/beneficiary-notices-initiative. Published December 18, 2025. Accessed August, 2024.

- Medicare Learning Network. Advance beneficiary notice of non-coverage tutorial. Centers for Medicare & Medicaid Services. https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/ABN-Tutorial/formCMSR131tutorial111915f.html. Published August 2024. Accessed December, 2025.

- Social Security Administration. Limitation on liability of beneficiary where medicare claims are disallowed (Social Security Act Section 1879). https://www.ssa.gov/OP_Home/ssact/title18/1879.htm#ft688. Accessed December, 2025.